Incomes & Legacies

In the Mirror I Trust

You've worked hard, saved diligently, and made smart decisions. But now that you're facing the complexities of retirement, legacy planning, and long-term care... who do you trust to help guide the way?

We believe the answer should be you

You control your assets, with a paid consultant to guide your journey.

Our consultants never earn a commission, a fundamental tenet for unbiased advice.

Nobody cares more about your money than you! But that doesn’t mean you don’t need a sounding board who can discuss the pros and cons of different strategies.

We offer fee-based income and legacy planning tailored to young Boomers and older Gen Xers as they navigate the shifting landscape from asset accumulation to income distribution.

Meet Thomas B. Henriques, CRPC®

Founder & President | Fiduciary Consultant

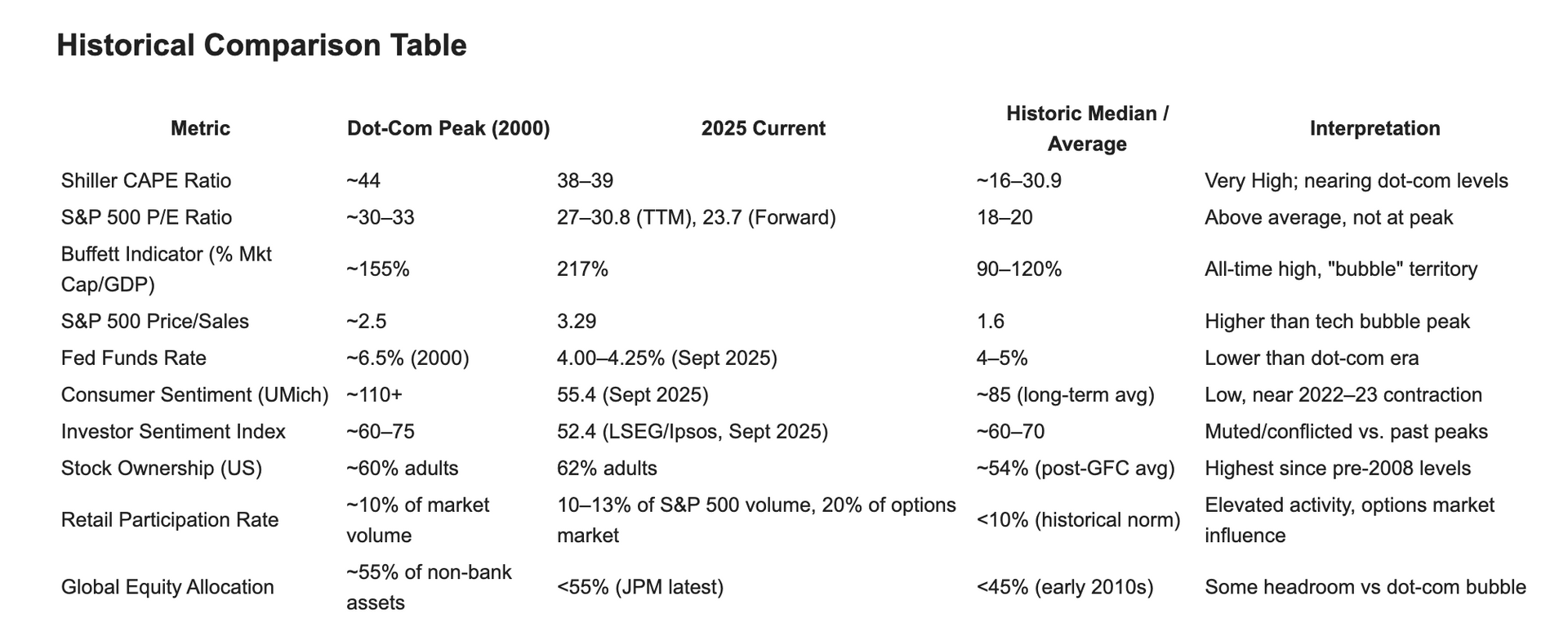

Tom founded Incomes and Legacies after decades of working in both high-level investment and insurance roles, including growing the investment and insurance branches at Navy Federal Credit union through the 2008 financial crisis and working at Morgan Stanley through the dot-com crash. He has always been fascinated with the relationship of people and their money and is a member of the Financial Therapy Association, a relatively new field that is devoted to understanding different financial attitudes and behavior.

Through more than 10,000 one-on-one financial interviews, he saw a recurring pattern: conflicted advice, overly complex products, and consumers paying for guidance disguised as sales.

That's why he created a consulting firm focused on clarity, education, and client empowerment. With certifications in retirement planning and a background spanning Wall Street, credit unions, and independent consulting, Tom brings deep knowledge, sharp instincts, and genuine care to every client interaction.

29

Years of Experience

10K+

One-On-One Financial Consultations

1K+

Satisfied Clients

Why We're Different

Most financial professionals still operate under a sales-first model, earning commissions from products they recommend or charging a percentage of assets they manage.

We take a different approach.

01

Flat-Fee Consulting

02

Not a Captive Agency

03

Independent And Agnostic Services

04

Education-First, Always

Whether you're trying to protect your retirement savings, explore annuity options, plan for long-term care, or prepare an estate strategy, you deserve guidance that's aligned with your best interests; not someone else's compensation structure.

Built for young Boomers & older GenXers, by an older GenXer

Founder & President | Fiduciary Consultant

We specialize in working with people approaching or in retirement: those born between 1955-1975 - a cohort that is fiercely independent yet sometimes overlooked.

We’ve lived through market crashes, housing bubbles, and economic uncertainty. We may be raising kids, supporting aging parents, and preparing for retirement, all at once.

At Incomes and Legacies, we speak your language. We help you build your plan, protect what you’ve earned and preserve your legacy.

Our Philosophy: Plan. Protect. Preserve.

Plan

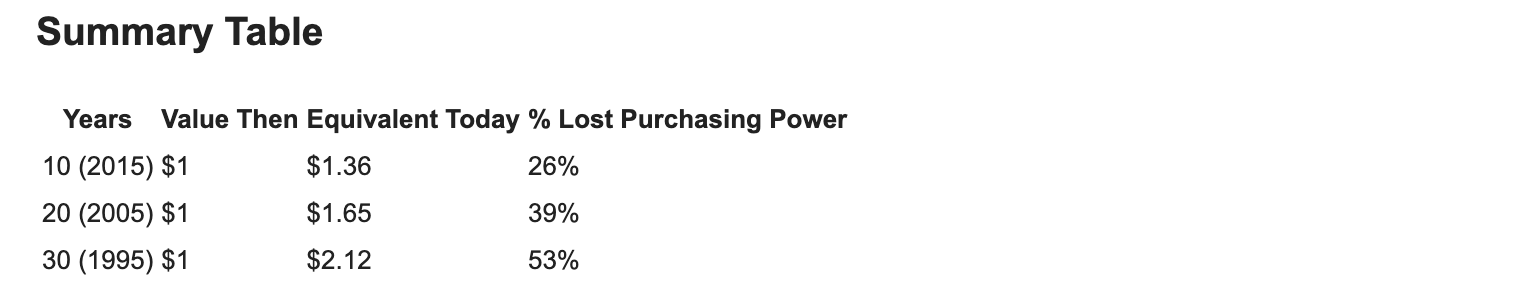

your income so it keeps pace with inflation, covers your basic needs and lasts as long as you do.

Protect

your assets from the perils of market crashes, long term care scenarios and inflation.

Preserve

your legacy (if desired) to leave more than memories.

Let’s build a future that works for you based on your personal goals and family situation.

A Message From Our President

"I'm a Democratic Capitalist. This means I believe the most effective way to create a governmental system is through democracy and the most effective economic system that fosters innovation, efficiency and competition through a profit motive is capitalism. Both systems are not without their critics and flaws, but the American experiment has to be regarded as the greatest success story in human history. The Stock Market is the epitome of capitalism and investing in a diversified group of high quality, blue chip companies has historically been a phenomenal compounder of wealth. The advent of no-load mutual funds and ETFs has enabled the average investor to participate in this story, but it is not without significant risk, especially when one reaches the age of transitioning from accumulation to distribution. Most Americans live their financial lives based on the monthly income they generate, but in retirement many find themselves with a large sum of saved and invested money but no real plan to use and enjoy their nest egg without the stress of exhausting their funds, prolonged market downturns or the possibility of needing some sort of help or care before they pass away. Our goal at Incomes and Legacies is to show you how to "Index your Investments" but also to "Individualize your Insurance". This means minimizing the fees you pay on your investments but also personalizing your specific insurance and income needs. If you take the risk, you shouldn't have to pay anyone to do it. But the complex world of annuities, long term care and wealth transfer life insurance is where an agnostic advisor can be an invaluable sounding board. In the opaque world of hidden fees, high commissions and broken promises, understanding the pros and cons of each appropriate product can empower the consumer to make an educated and customized plan. Let us earn your trust by starting a conversation."