Strategies

A Better Way to Balance Risk & Security

You've built a life: a family, a home, a career. Now you're asking: "What's Next?"

At Incomes and Legacies, we help you create a plan that combines growth, protection, and peace of mind.

Our strategy is simple but powerful:

Index your investments. Individualize your insurance.

We help you align your money with your goals. No sales, just guidance.

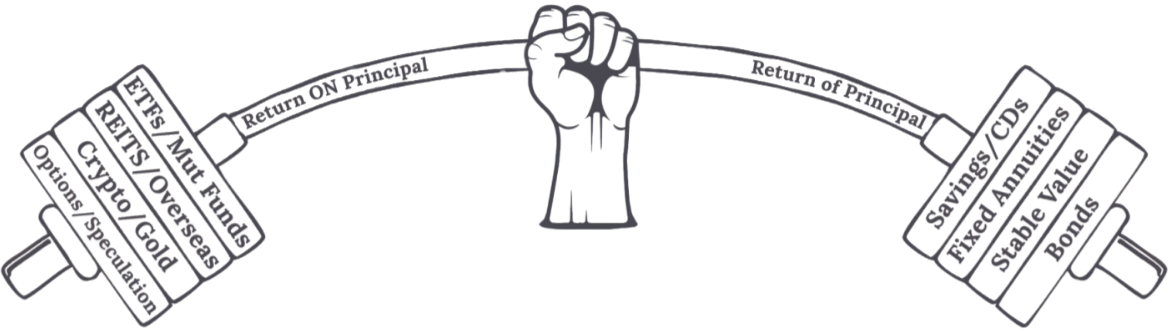

The Financial Barbell: Return On Principal + Return of Principal

Most people's portfolios lean too heavily in one direction, all growth or all caution. We believe in a barbell strategy that balances both ends.

Speculative Assets

(For Growth)

- Stocks

- ETFs

- Crypto

- Real Estate

Guaranteed Accounts

(For Security)

- Annuities

- Insurance-Based Tools

- Cash Reserves

This diversified approach helps you build wealth, protect it, and create income streams that last a lifetime.

Compare Your Options

| Asset Class | Risk Level | Return Potential | Liquidity | Best For |

|---|---|---|---|---|

| ETFs / Stocks | Moderate - High | High | High | Growth & sector targeting |

| Bonds (Funds / ETFs) | Moderate | Moderate | Moderate | Income & portfolio ballast |

| Real Estate | Moderate - High | Moderate - High | Low | Tangible asset & equity growth |

| Annuities | Low - Moderate | Moderate | Low | Guaranteed income |

| Insurance (Life / LTC) | Low | N/A | N/A | Legacy & long-term care |

| Cash / CDs | Low | Very Low | High | Emergency fund / short-term needs |

Want to know how your current investments compare?

strategies tailored to where you are

Age 55

Start the Shift

- Begin repositioning aggressive portfolio toward preservation

- Explore early withdrawal opportunities (Rule 72(t), hardship exceptions)

- Reevaluate insurance, income sources, and long-term care gaps

Age 60

Pre-Retirement Planning

- Make catch-up contributions and review Roth vs. Traditional balances

- Consider converting savings into guaranteed income streams

- Evaluate annuity options with elevated rates before retirement

Age 73

Required Minimum Distributions (RMDs) & Lifestyle Planning

- Optimize tax efficiency around RMDs and Social Security

- Balance income needs with legacy goals

- Reassess risk tolerance and potential long-term care costs

Questions We Help Answer

- Do I know what I actually own, and why?

- Is my money positioned for income, growth, or both?

- Should I take Social Security now or wait?

- Can I generate income without sacrificing peace of mind?

- What happens to my spouse or heirs if something happens to me?

Insights that make a difference

We'll guide you through:

- Investment allocation reviews

- Retirement income planning

- Annuity and insurance education

- Estate planning integration

- Long-term care preparation

- Tax-sensitive withdrawal strategies