Jack & Jane Smith

COUPLE - 55 YEARS OLD

Background:

The Smiths have 3 children all of whom are in college or graduated. They diligently saved for their children's education and paid for it with a combination of 529s, scholarships and help from grandparents. They are slowly embracing the idea of being empty nesters and are now focused on themselves - both today and for the next chapter of their lives.

Income/Careers:

Jack is a trademark attorney at a local firm and Jane is an 8th grade science teacher. He made $200k last year and she earned $80k.

Assets:

Jack has a 401k that he has been contributing the max to since he started at the firm. He has accumulated $1.5M in the account and it is all in the 2035 retirement fund because he doesn't really understand investments. He is adding the max of $31k each year plus his firm adds 3% of his salary ($6k). Jane has two retirement accounts, one is a pension thru the state and the other is a 457B account. She too has the 2035 fund and has accumulated 225k in her account. She is adding 6% of her salary ($4800) plus she is adding 3% to her future pension. The only debt the Smiths have is the first mortgage on their house which is worth $1.1M and the mortgage is $425k at 3.25%. They own two cars that are paid for and have almost $250k at the bank in a savings account. $200k of that was an inheritance from Jane's uncle.

Goals/Concerns:

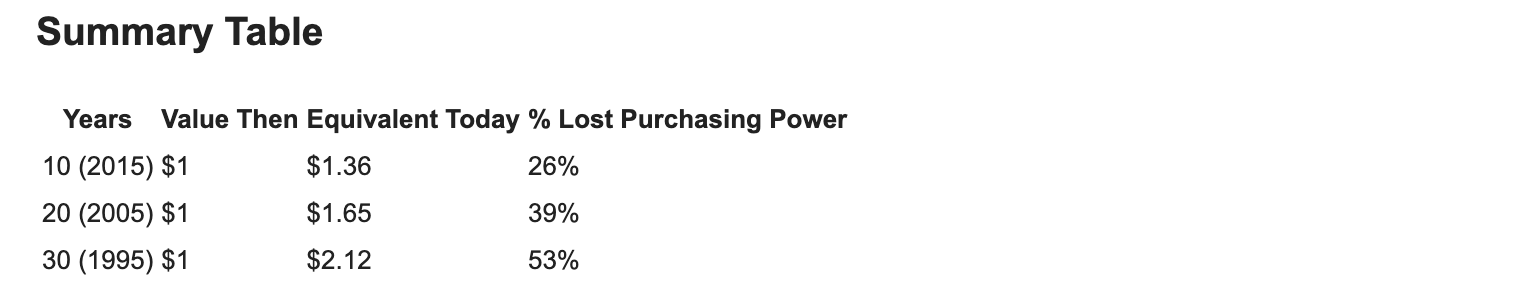

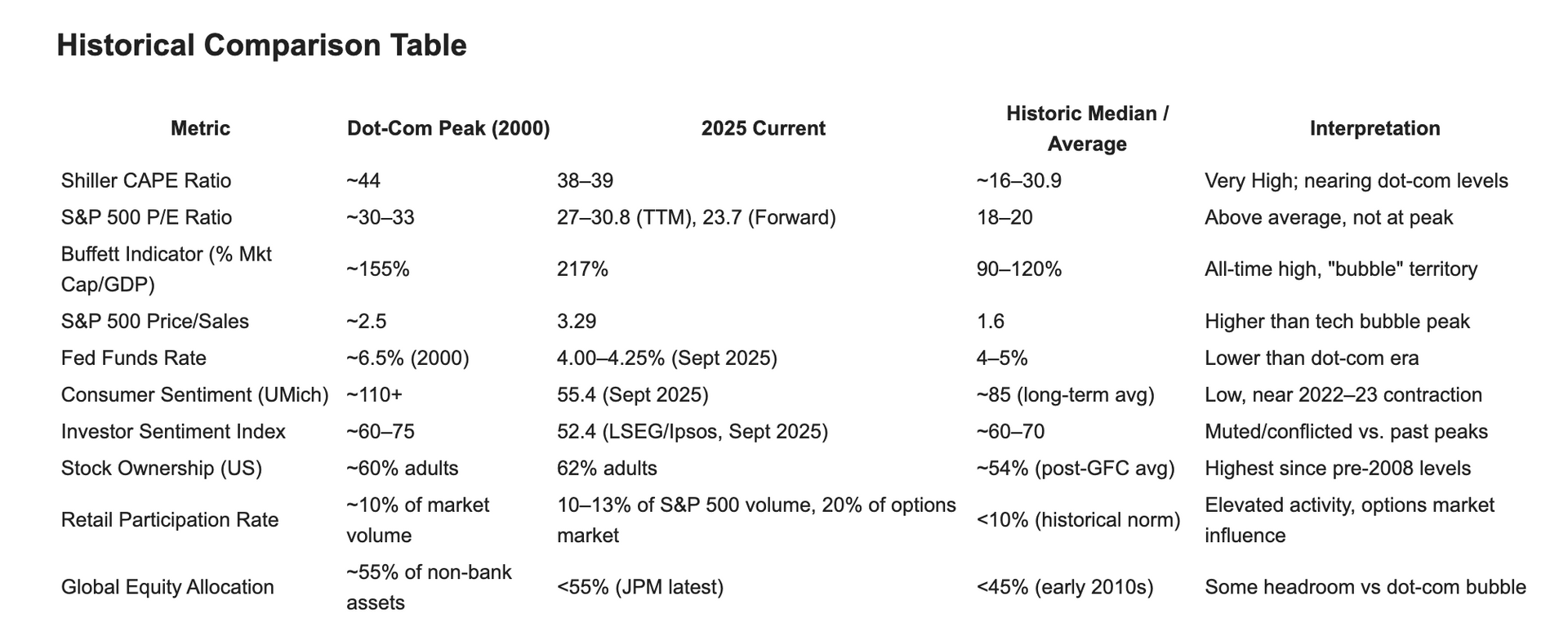

They don't know what to do with the funds they received from Jane's uncle and are unclear about whether they are properly invested and diversified. They hate Pres Trump and are concerned his policies may adversely affect their money but they know they have to invest to attempt to have enough money to retire. Jack's Dad has Parkinsons Disease so they are aware of the devastation of a long term health issue and the associated costs. They have life insurance thru work and don't really consider an inheritance to their kids important - "they'll get what they get" - their biggest dream is to figure out when they can retire and how much income they can plan on, ideally in 10 years when they are both 65. They don't expect to receive any other inheritance money. They love to cruise and want to downsize in the next couple years but plan on retiring locally because all of their kids plan on living nearby.

Analysis:

10 year extrapolation of their retirement accounts with their annual additions. Look at the options, flexibility and fees of each 2035 fund. With their concerns about Trump and their basic understanding the American stock market is "expensive", look to see what overseas exposure they have as well as sectors like small cap value etc that are less susceptible to the concentration of the giant companies making up the S&P 500. Discuss options for their $200k received from Jane's uncle - she is adamant she doesn't want to "lose" it - and look at some type of annuity with a long-term care rider (they can use the income but there is extra money there if one needs care). Contact SS and get their estimated figures at 62, 65 and 70. Contact Jane's school and get an estimate for her pension as well as traditional LTC options (if applicable). Discuss in further detail their housing situation (cost of new house and cash from existing home).

Post Planning:

Jack - we were able to move $500k of his 401k into his own personal deferred annuity/pension paying 5% for 10 years. Since they are concerned about inflation from tariffs and "over-printing" they did not want to chance losing money in the fixed income portion of his 401k. They now "know" that that account will grow to approximately $815k in 10 years and don't have to think about it anymore. This allowed him to invest in 100% equities in his remaining 401k and we designed a professional portfolio in different sized companies across the globe. Jane was happy to leave her 2035 fund alone as further diversification and the school systems choice was better than Jack's. We also learned her pension would be $30k/yr at 65 and ran all the SS numbers. Jane looks to receive $2500/mo in SS and Jack $4000 at 65. This equates to anticipated income of $5k for Jane and $4k for Jack at 65 or approx $108k/yr. The Smiths plan on selling their house in two years and netting approx $600k, of which their plan is to pay cash for their new house. They have decided to invest the $250k in laddered CDs and high yield savings to keep the money safe and somewhat liquid. They will look at options for their next planning session after they sell their house and will include looking at self insuring for LTC or buying a policy thru her work or on their own in some sort of annuity/LTC combo. At that point we will do a new analysis to see where they are and what extra income we can hope to generate, both guaranteed amounts and investment returns.