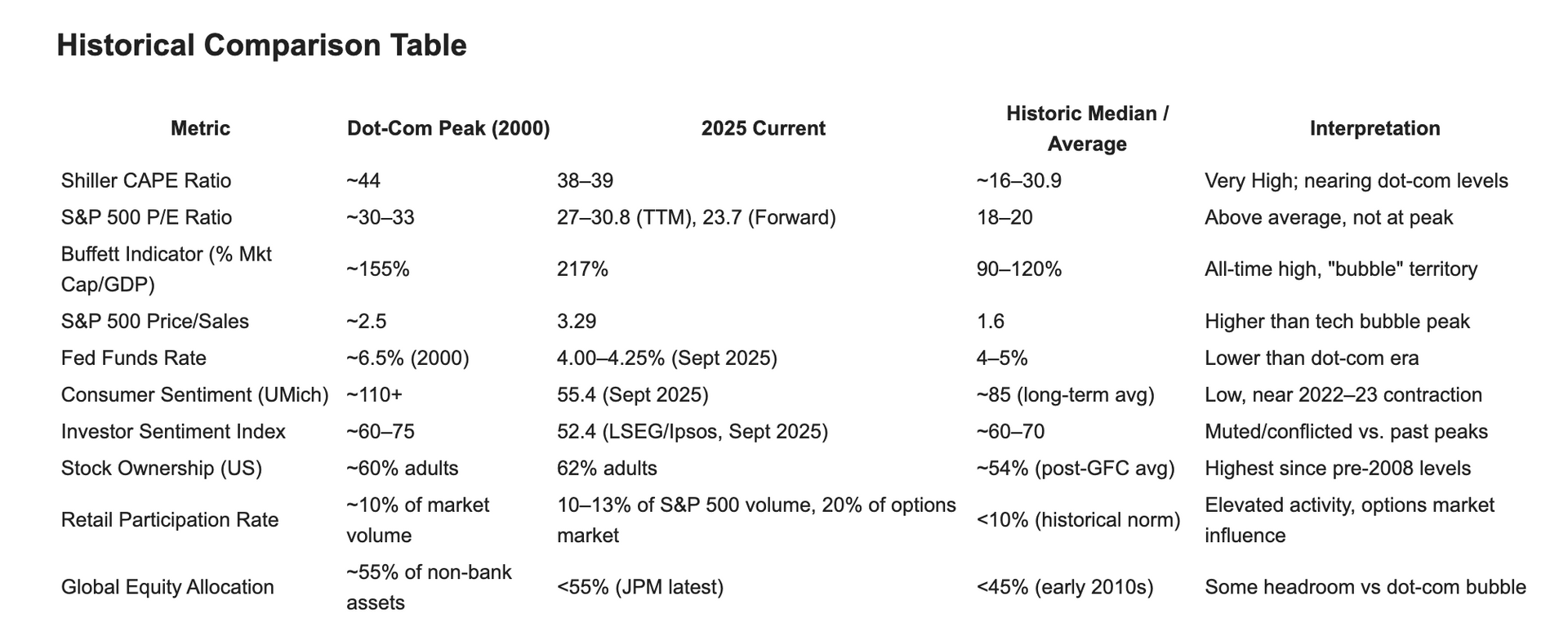

How a 5% MYGA Can Grow Your Retirement Savings Over 10 Years

See how steady, guaranteed growth can give you peace of mind, even in uncertain markets.

If you’re worried about market swings or low yields from bonds, you’re not alone. Many pre-retirees and retirees are turning to Multi-Year Guaranteed Annuities (MYGAs) to lock in steady, predictable growth.

Let’s take a closer look at how a $100,000 investment in a MYGA earning 5% interest, compounded annually, can build real security over 10 years.

Annual Growth Table: $100,000 at 5% for 10 years

| Year | Start Balance | Interest Earned (5%) | End Balance |

|---|---|---|---|

| 1 | $100,000 | $5,000 | $105,000 |

| 2 | $105,000 | $5,250 | $110,250 |

| 3 | $110,250 | $5,512 | $115,762 |

| 4 | $115,762 | $5,788 | $121,550 |

| 5 | $121,550 | $6,078 | $127,628 |

| 6 | $127,628 | $6,381 | $134,009 |

| 7 | $134,009 | $6,700 | $140,710 |

| 8 | $140,710 | $7,036 | $147,746 |

| 9 | $147,746 | $7,387 | $155,133 |

| 10 | $155,133 | $7,757 | $162,890 |

What this Means

After 10 years, your original $100,000 investment grows to $162,890, thanks to the guaranteed 5% annual growth. That’s a total of $62,890 in interest earned, with no market risk and no guesswork about future returns.

Why Consider a MYGA?

- Guaranteed Growth: Unlike stocks or bond funds, your MYGA’s return is locked in by the insurance company.

- Tax Deferral: Growth inside the MYGA isn’t taxed until you withdraw.

- Principal Protection: Your original investment and the interest are protected from market volatility.

Final Takeaway

If you’re looking for a safe, steady way to grow your money without worrying about what the markets are doing, a 5% MYGA can be a powerful solution.

Ready to see how a MYGA can fit into your retirement income plan? Let’s talk. We’re here to give you clear, honest guidance with no sales pitch.