Articles on the Overvaluation of Today's Stock Market

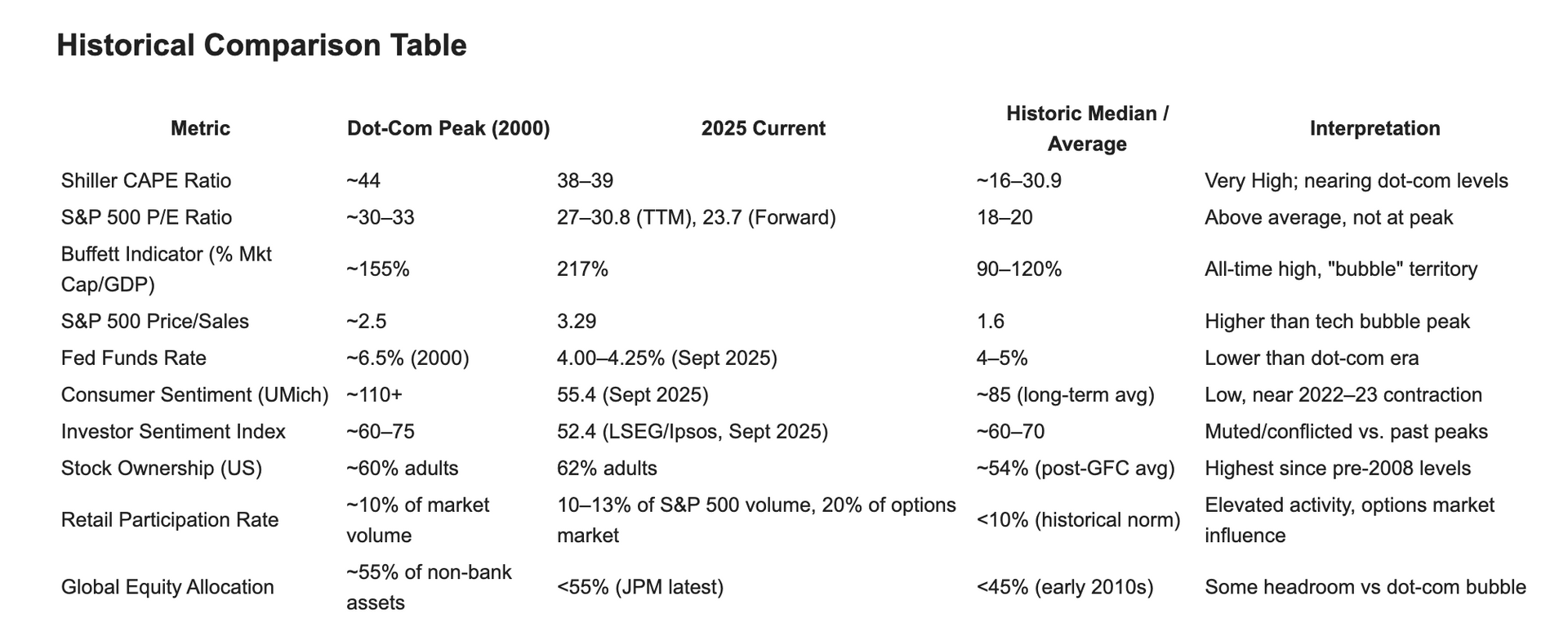

what is the historical average valuation of the stock market and where are we today? the buffet indicator, cape ratio and more

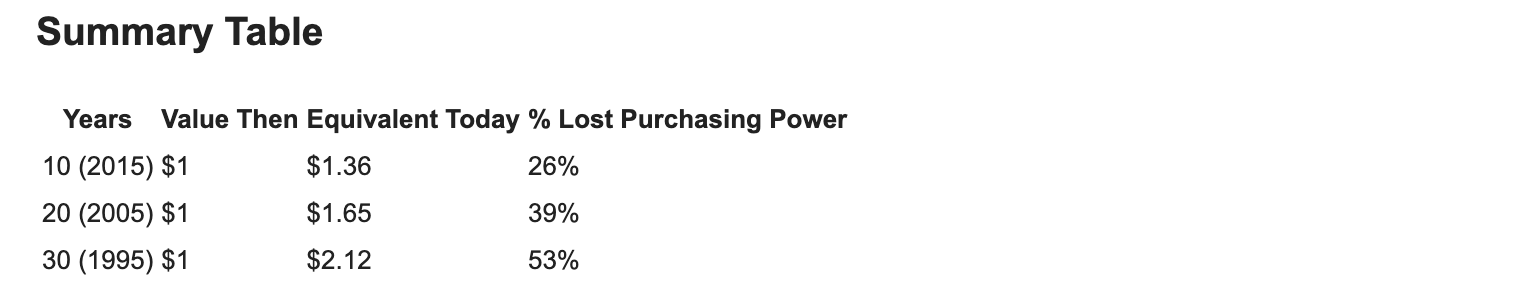

"Nobody can time the Market" or "It's time IN the Market, not the timing OF the Market" or "Over the long term stocks have historically always gone up" are popular and overused phrases used on Wall Street. Sometimes, however, investors' excitement turns into "irrational exhuberance" to use a phrase Alan Greenspan coined in 1996. But that exhuberance can last far longer than most believe, and there are many parallels to the AI excitement seen today compared to the mid-90's when he made that comment. Below are several articles discussing comparable valuation methods used to see how investors are valuing stocks today compared to history. Stocks, and specifically the S&P 500 should always be the foundational cornerstone of any investors portfolio, but it is helpful to understand history.

https://www.currentmarketvaluation.com/models/buffett-indicator.php

https://www.wallstreetprep.com/knowledge/equity-risk-premium/