Should I Invest in Gold or Bitcoin or BOTH

How do I use ETFs to buy bitcoin and gold for a very small portion of my portfolio as a hedge against inflation, debt and turmoil in general

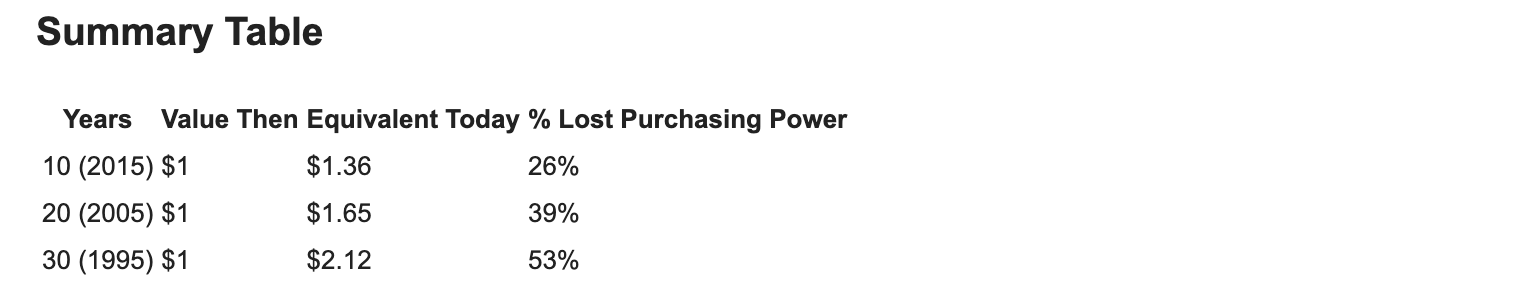

Many investors believe that inflation is one of the most corrosive aspects of fiat, or paper currency. As politicians make promises, governments inevitably end up "printing more" of it, thus devaluing the existing circulation. In 2025, the US debt is around $37T and is adding approximately $2T each year to that figure. Gold has been used for over 2500 years as "real money" and, very recently the advent of bitcoin (2008) has given investors another option to battle against the never-ending promise/print cycle. Of course investors can buy gold coins or bars to get exposure to the yellow metal and Bitcoin wallets provide the same opportunity for the cryptocurrency, but ETFs are another way to "express one's view" in a traditional brokerage account. This alleviates some of the logistics of storing gold or bitcoin and, for a small percentage of one's portfolio, can create a valuable hedge to complement a stock and bond portfolio. Your consultant can discuss the pros and cons of these strategies and let you know which ETF(S) is the most appropriate vehicle.

Should You Buy Gold and Bitcoin Using ETFs?

Weighing the Pros and Cons for Modern Investors

Why Investors Turn to Gold and Bitcoin ETFs

Both gold and bitcoin have captivated investors seeking alternatives to traditional stocks and bonds. Exchange-traded funds (ETFs) make it easier than ever to gain exposure to these assets without the hassles of direct ownership. Here’s why many choose ETFs for gold and bitcoin:

Reasons to Buy Gold ETFs

- Inflation Hedge: Gold is renowned for preserving purchasing power during inflationary periods.

- Portfolio Diversification: Gold often moves independently from stocks and bonds, helping reduce overall portfolio risk.

- Liquidity: Gold ETFs are traded on major exchanges, making it easy to buy and sell shares at market prices.

- No Storage Hassles: Unlike physical gold, ETFs eliminate the need for secure storage and insurance.

- Transparency: Holdings and costs are clearly disclosed, and ETFs are subject to regular audits.

Reasons to Buy Bitcoin ETFs

- Easy Access: Investors can gain exposure to bitcoin through a regular brokerage account—no need for crypto wallets or exchanges.

- Regulated Environment: ETFs operate under strict regulatory oversight, potentially reducing risks of fraud or hacking.

- Tax Efficiency: Bitcoin ETFs can be held in tax-advantaged accounts like IRAs and 401(k)s, which is difficult with direct bitcoin ownership.

- Liquidity and Convenience: ETFs trade on stock exchanges, offering high liquidity and ease of transaction.

- No Technical Barriers: Investors avoid the complexities of managing private keys or securing digital assets themselves.

Key Pros and Cons

Gold ETFs

Pros:

- Hedge against inflation and currency devaluation

- Portfolio diversification

- Highly liquid and easily tradable

- No need for physical storage or security

Cons:

- No physical ownership—can’t use for jewelry or personal use

- Management fees reduce returns over time

- Gold prices can still be volatile and may underperform equities

- Tax treatment may be less favorable in some regions115

Bitcoin ETFs

Pros:

- Simple, regulated access to bitcoin exposure

- No need to manage digital wallets or private keys

- Can be held in retirement accounts for tax advantages

- High liquidity and ease of trading

Cons:

- High price volatility—potential for rapid gains and losses

- Higher fees compared to traditional stock ETFs

- No direct bitcoin ownership—cannot use for transactions or self-custody

- Regulatory risks and evolving legal landscape93

Conclusion: Which Is Right for You?

Investing in gold or bitcoin via ETFs offers convenience, liquidity, and regulatory oversight—making these assets accessible to a broader range of investors. Gold ETFs can serve as a stabilizing force in your portfolio, while bitcoin ETFs offer a gateway to the high-risk, high-reward world of digital assets.

The best choice depends on your risk tolerance, investment goals, and interest in direct ownership versus convenience. Always consider the pros and cons before adding these ETFs to your portfolio, and consult with a financial advisor to ensure they align with your broader strategy.