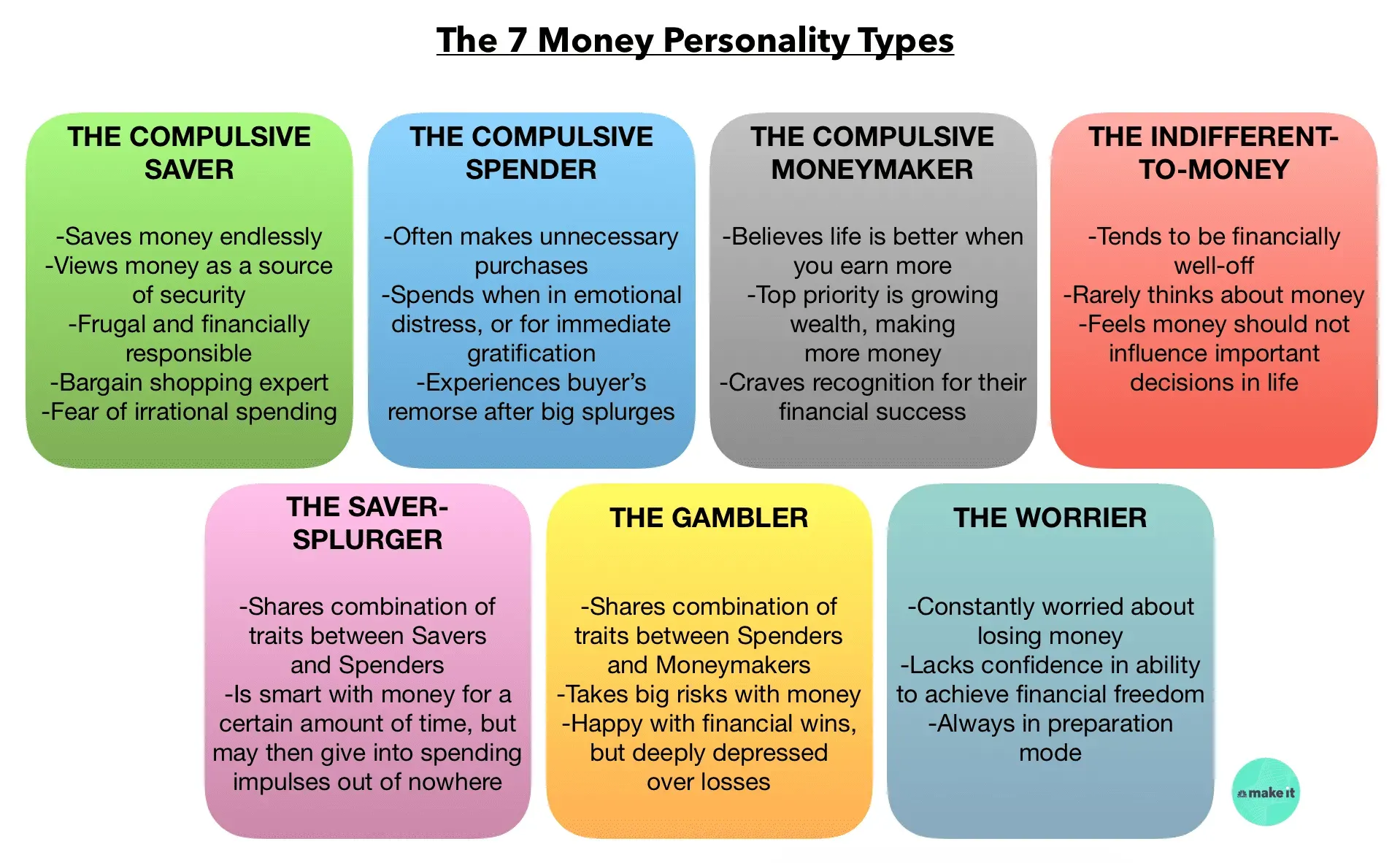

How your personal experience with money from an early age can impact our view of money as an adult

Financial Therapy, Behavioral Finance and the "science" behind why you feel and act the way you do towards saving spending investing or ignoring your money

The growing field of behavioral finance is a fascinating one. The vast majority of investors suffer far greater "pain" when they lose money than the corresponding "good" feeling when an investment grows. This pain/gain ratio expands the closer one gets to retirement. Talking through your money feelings with a professional consultant can help you understand a variety of risks and alleviate some of the stress making "money decisions" can generate. If you have a partner, discussing personal financial views with a facilitator can often expose fundamental differences with respect to spending, saving and investing and allow for truly honest and frank conversations and attempt to create a plan that accommodates the wishes of both parties, if possible.

https://greatness.com/discover-your-money-personality-type/