Investing and Asset Allocation 101 - 60/40 ratio and target date funds -

Understanding what you own, what you don't own and what you might want to add in your overall portfolio to create greater diversification

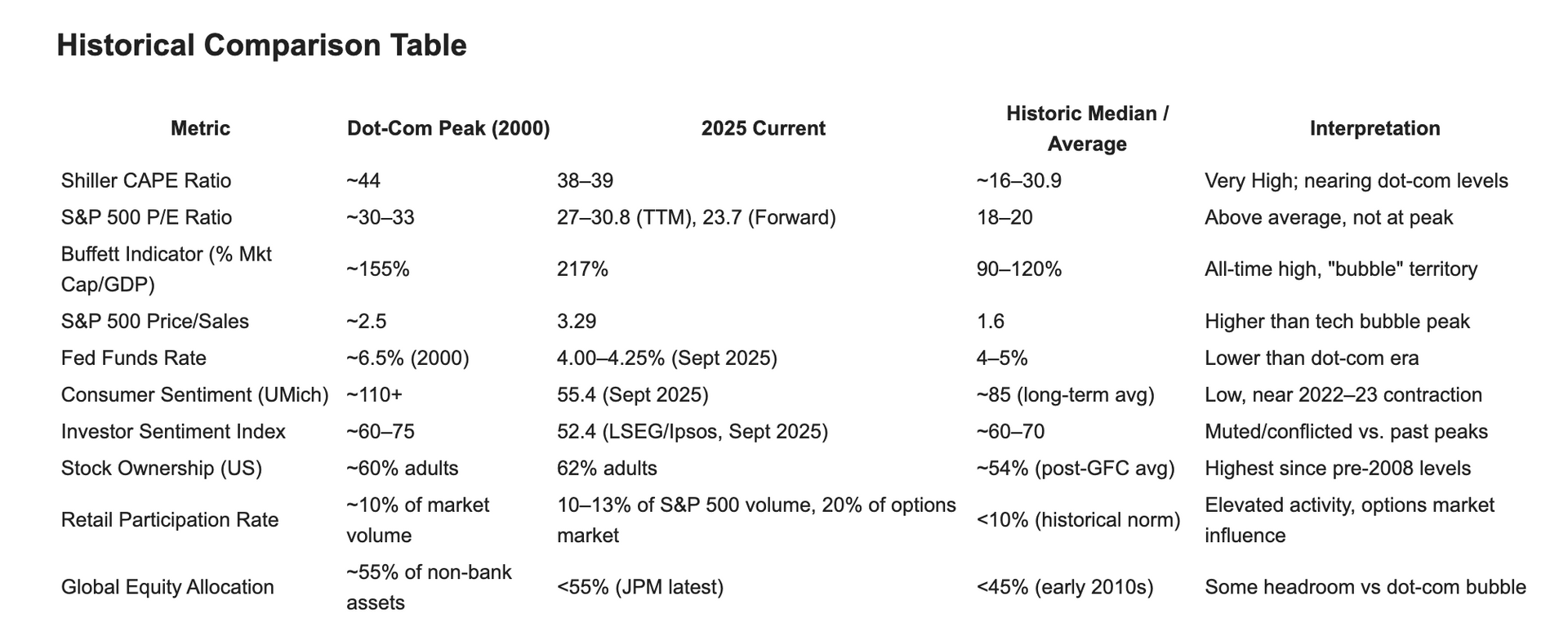

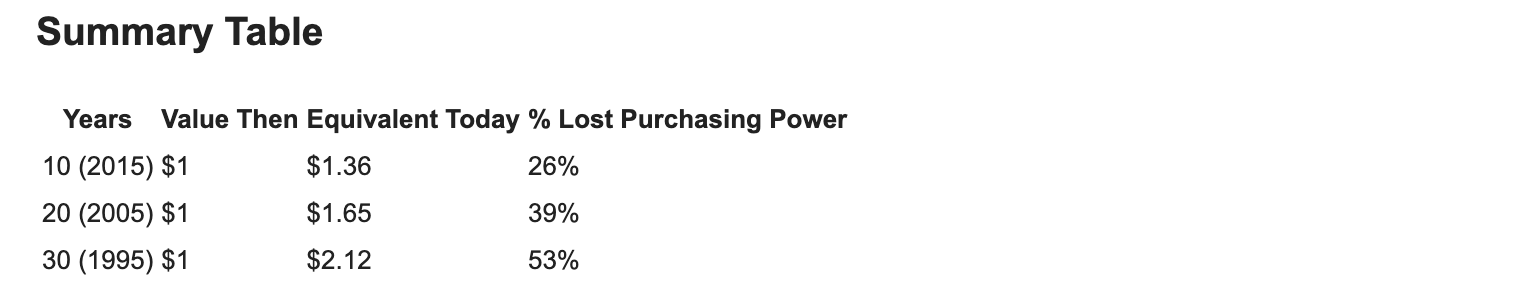

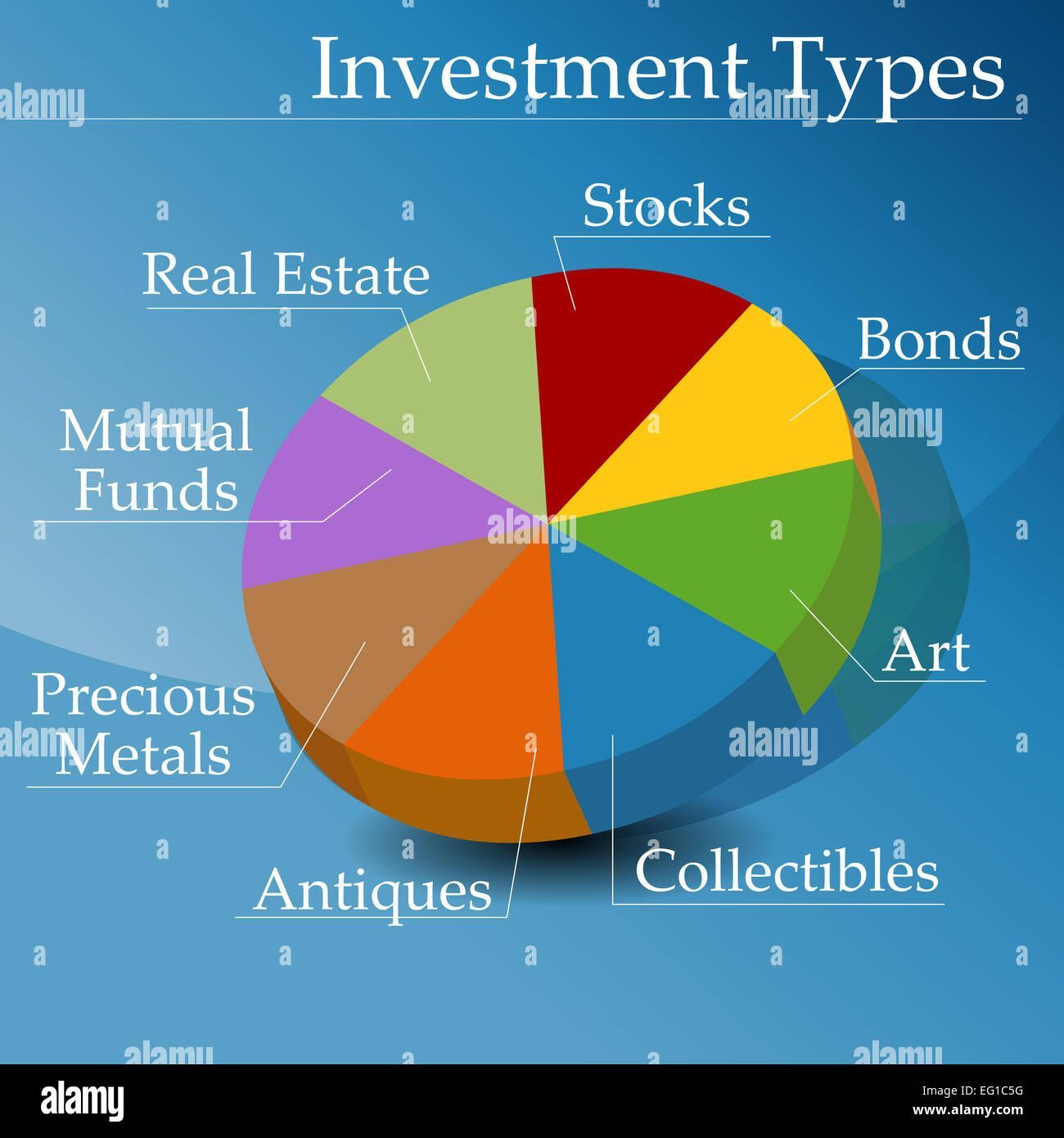

Most people have a general idea that if they invest in stocks over the "long term" they would have historically made more money than if they put that money in the bank. Far fewer people understand what bonds are and even less understand what asset allocation is and how it impacts their potential for "the total return" or dividends, interest and/or growth on their investments. Of course there are a host of different investments like crypto or real estate or stamps or art but for the vast majority of Americans with retirement accounts, their "serious" money is invested in stocks and bonds.

When you invest in a 60/40 portfolio, that means 60% is invested in a variety of different stocks and 40% invested in different bonds. It is the same "allocation" that you would find in a retirement target fund like a 2030 or 2035 fund.

The shorter your time horizon until you retire, the more conservative the ratio of stocks to bonds. When you own STOCKS, you are actually an owner of a tiny slice of a company. The "value" of each share is determined everyday the stock market is open and indicated by investors' willingness to take risk. The S&P 500 is the most well-known index in the world and comprises of 500 large and established companies. It is what is called a cap-weighted index (cap=capitalization) which means the larger the company is, the greater % you own when you buy 1 share of the S&P. In 2025, the top 3 companies (Microsoft, Nvdia and Apple) make up about 20% of the index, meaning .20 of every $1 you invest goes into just 3 companies! When you own BONDS, you own the debt of a company, municipality or country. The interest rate the entity is expected to pay is correlated to the prevailing rates (such as the "risk-free" rate of US treasuries) and the implied risk that the payer will be able to re-pay both the interest and the principal. The "value" of each bond is determined by the market and due to daily fluctuations of interest rates and the expected ability of the organization to pays its debt. Understanding what you own and why you own it is the first step in crafting a viable growth and income strategy.

https://www.investopedia.com/managing-wealth/achieve-optimal-asset-allocation/

https://www.sec.gov/about/reports-publications/investorpubsassetallocationhtm

https://www.finra.org/investors/investing/investing-basics/asset-allocation-diversification