How a 5% MYGA Can Deliver Inflation-Adjusted Income While Protecting Your Principal

See how a fixed annuity can provide growing income and preserve principal, even with rising withdrawals each year.

For many approaching retirement, one of the biggest worries is how to balance income security with rising living costs. A Multi-Year Guaranteed Annuity (MYGA) can be a powerful tool to create steady, inflation-adjusted income that still protects your original investment.

In this example, we’ll look at how a $100,000 MYGA earning a guaranteed 5% annually can keep paying you, even if you increase your withdrawals each year for inflation.

How the Strategy Works

Here’s what we’re assuming:

- Initial investment: $100,000

- Guaranteed interest rate: 5% (compounded annually)

- Year 1 withdrawal: $4,000 (4% of the original investment)

- Withdrawals increase by 4% each year to account for inflation

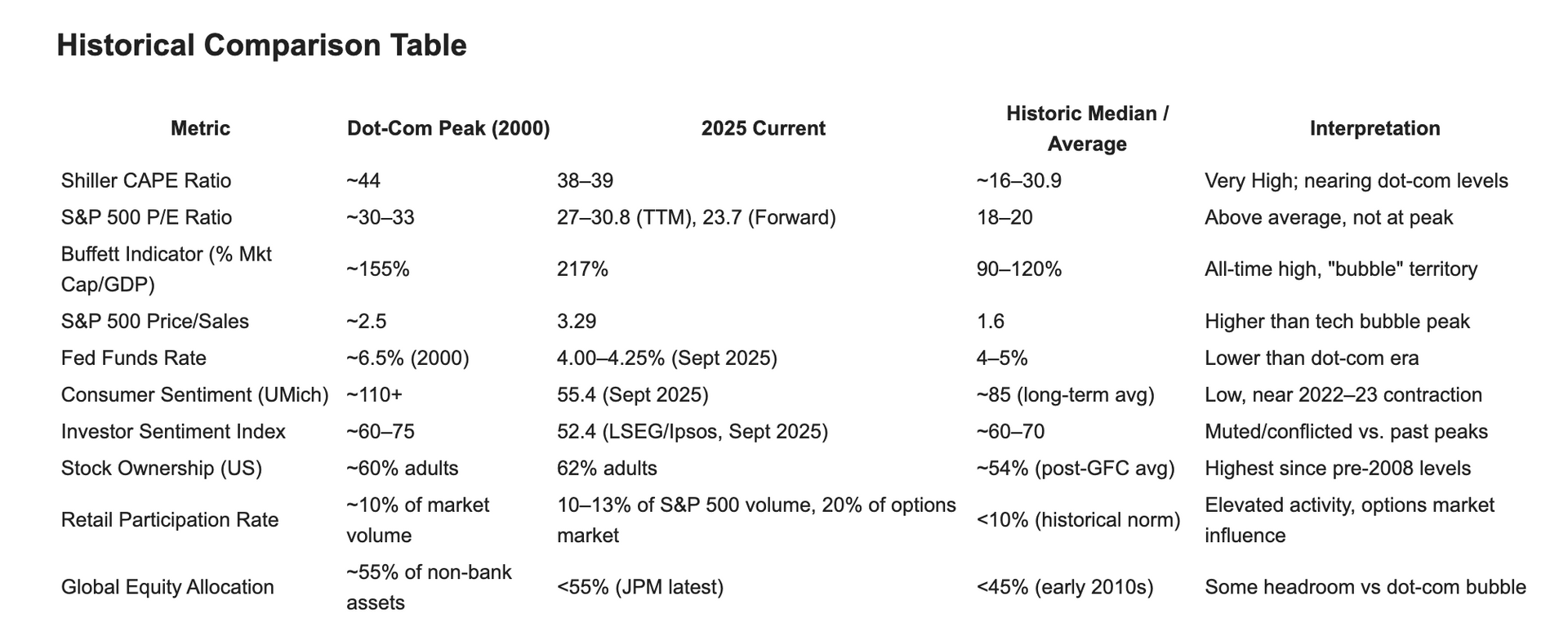

10-Year Growth & Withdrawal Table

| Year | Start Balance | Interest (5%) | Withdrawal (Inflation Adjusted) | End Balance |

|---|---|---|---|---|

| 1 | $100,000 | $5,000 | $4,000 | $101,000 |

| 2 | $101,000 | $5,050 | $4,160 | $101,890 |

| 3 | $101,890 | $5,095 | $4,326 | $102,659 |

| 4 | $102,659 | $5,133 | $4,499 | $103,293 |

| 5 | $103,293 | $5,165 | $4,679 | $103,779 |

| 6 | $103,779 | $5,189 | $4,866 | $104,102 |

| 7 | $104,102 | $5,205 | $5,061 | $104,246 |

| 8 | $104,246 | $5,212 | $5,263 | $104,195 |

| 9 | $104,195 | $5,210 | $5,473 | $103,932 |

| 10 | $103,932 | $5,197 | $5,692 | $103,437 |

How to Read the Table

- Start Balance: The amount at the beginning of each year

- Interest: Guaranteed annual interest earned

- Withdrawal: The inflation-adjusted withdrawal for that year

- End Balance: What remains after interest and withdrawal

What This Shows

Even though you’re increasing your withdrawals by 4% every year to account for inflation, the 5% guaranteed interest keeps the account growing slightly.

- Total withdrawals paid over 10 years: $48,019

- Ending balance after 10 years: $103,437

You’ve enjoyed inflation-adjusted income while preserving your original principal, a powerful example of how a MYGA can support your retirement lifestyle.

Is a MYGA Right for You?

MYGAs aren’t for everyone. They trade liquidity for guaranteed growth and protection, perfect for those seeking predictable income and peace of mind in retirement.

If you’re curious how a MYGA could fit into your financial picture, let’s talk. Book a consultation to get started.