The Power of MYGAs: A 10-Year Look at Tax-Deferred Growth

Explore how MYGAs with guaranteed 5% returns stack up against AGG and BND bond ETFs for safe, steady retirement income.

When you’re planning for retirement, one of the biggest questions is: How can I balance safety with growth? Two popular options are Multi-Year Guaranteed Annuities (MYGAs) and bond ETFs like AGG and BND. While they might seem similar at first glance, their performance and purpose are quite different. Let’s compare how a 5% MYGA stacks up against these common bond ETFs — and why it might be a better fit for those who value guaranteed growth and tax-deferred security.

What is a MYGA?

MYGA (Multi-Year Guaranteed Annuity): An insurance product offering a fixed, guaranteed interest rate (here, 5%) for a set number of years (e.g., 5 or 10 years). Principal and interest are guaranteed by the insurer and grow tax-deferred.

What are AGG and BND?

When you’re planning for retirement, one of the biggest questions is: How can I balance safety with growth? Two popular options are Multi-Year Guaranteed Annuities (MYGAs) and bond ETFs like AGG and BND. While they might seem similar at first glance, their performance and purpose are quite different. Let’s compare how a 5% MYGA stacks up against these common bond ETFs — and why it might be a better fit for those who value guaranteed growth and tax-deferred security.

- AGG and BND: Low-cost, diversified ETFs tracking the U.S. investment-grade bond market. They are highly liquid, offer daily pricing, and can be bought or sold at any time.

- Historical Average Annual Returns:

- 5-Year: ~1.2%

- 10-Year: ~1.3%

- (Returns as of late 2023–2024; both funds have nearly identical performance).

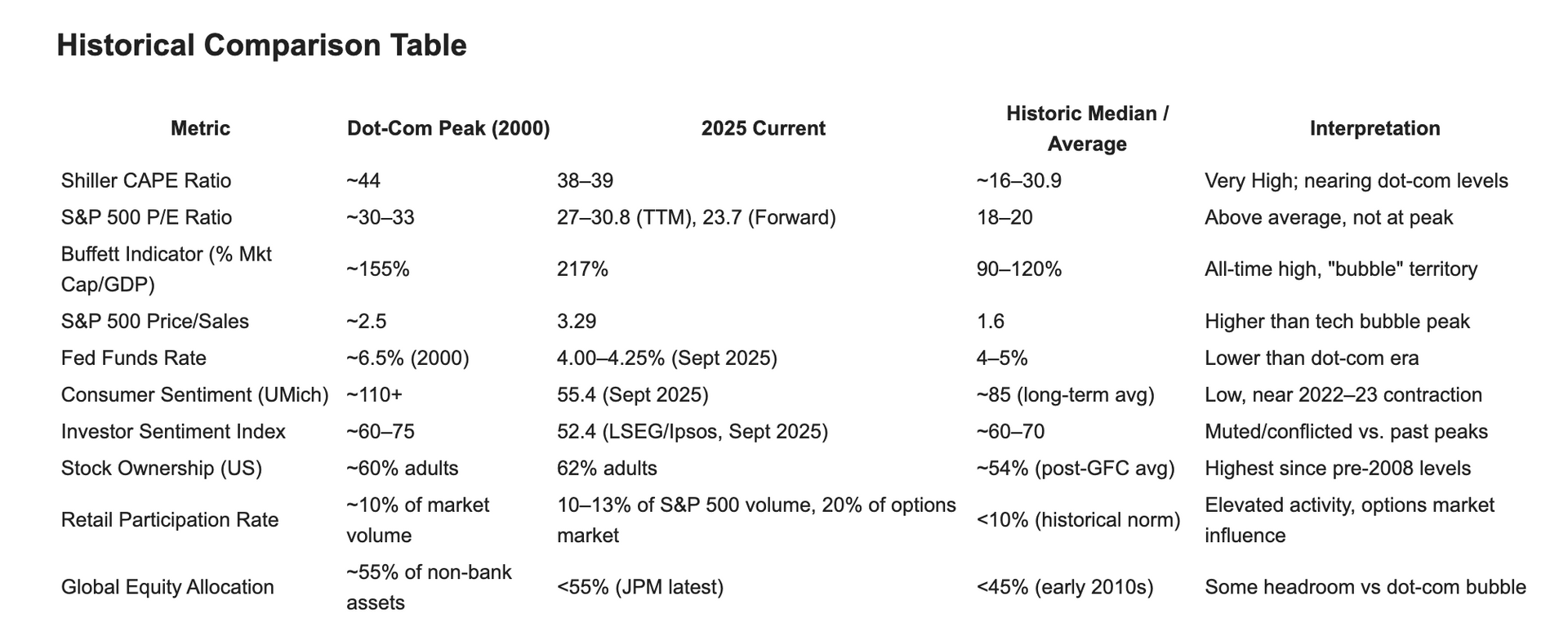

Performance Comparison Table

| Product | 5-Year Avg Annual Return | 10-Year Avg Annual Return | Liquidity | Tax Deferral | Principal Guarantee | Rate Risk |

|---|---|---|---|---|---|---|

| MYGA (5%) | 5.00% (guaranteed) | 5.00% (guaranteed) | Low (surrender penalties) | Yes | Yes | None (fixed) |

| AGG | ~1.2% (historical) | ~1.3% (historical) | High | No | No | Yes |

| BND | ~1.2% (historical) | ~1.3% (historical) | High | No | No | Yes |

Key Considerations

MYGA (5%)

Pros:

- Guaranteed 5% annual return for the contract period37.

- Principal and interest are protected by the insurer.

- Tax-deferred growth until withdrawal.

Cons:

- Returns are not guaranteed and have been low (~1.2%–1.3% annualized over 5–10 years)2568.

- Prices can fall if interest rates rise (rate risk).

- No tax deferral unless held in a retirement account.

Example: $100,000 Investment

| Product | Value After 5 Years | Value After 10 Years |

|---|---|---|

| MYGA (5%) | $127,628 | $162,889 |

| AGG/BND | ~$106,167 | ~$113,600 |

Assumes MYGA compounds annuity at 5%; AGG/BND use 1.3% historical average

What Does This Mean?

MYGA (5%) offers much higher, guaranteed growth but locks up your money for the term and has penalties for early withdrawal. AGG and BND are flexible, liquid, and diversified, but have delivered much lower historical returns and are subject to price drops if rates rise.

At a Glance

- A 5% MYGA offers a much higher, guaranteed return over 5 or 10 years compared to AGG or BND, with the tradeoff of reduced liquidity and insurer credit risk.

- AGG and BND provide flexibility and daily liquidity but have delivered much lower historical returns and are subject to interest rate risk.

- MYGAs are best for investors prioritizing safety, tax deferral, and guaranteed growth over a set period, while AGG/BND suit those who value liquidity and market access.

Choosing the right balance between growth and safety depends on your unique goals, time horizon, and comfort with risk. While AGG and BND offer flexibility and easy access to the bond market, the 5% MYGA stands out for those seeking a guaranteed return and peace of mind. As always, consider your liquidity needs and overall financial plan before making a decision. If you’d like help figuring out which approach fits your retirement strategy best, let’s talk. We’re here to guide you without the sales pitch.